- Pension Call Center

- 1599-2080

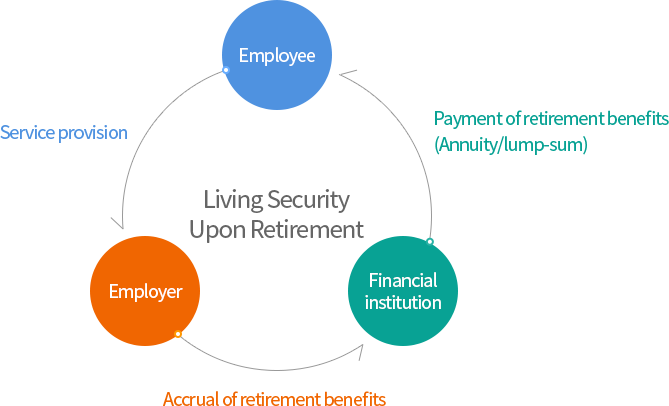

What is a retirement pension plan?

A statutory retirement benefit system designed to help employees ensure stable livelihood in their old age, whereby the employer accrues the financial resources for its employees’ retirement allowances in an outside financial institution while the employee works for the company, and the employee receives their retirement benefits from the financial institution in the form of an annuity or lump-sum payment.

Retirement Pension Plan

Implementation of Retirement Pension Plan (December 2005)

The severance pay system under the Labor Standards Act was converted to the retirement benefit system in line with the introduction of the retirement pension system. The retirement benefits system is a broader concept than the severance pay system, providing employer and employee with more options.

Depositor Protection

- The DB plan is not protected by the Korea Deposit Insurance Corp. under the Depositor Protection Act.

- The DC plan and IRP is protected under the Depositor Protection Act only for reserves invested in financial products subject to depositor protection. In such cases, protection is limited to KRW 50 mil per person, which is apart from the depositor protection limit for your other financial products. The amount in excess of KRW 50 mil is not subject to protection. In case of enrollment in two or more retirement pension plans, they shall be protected for up to a collective total of KRW 50 mil.